Tax Assessor-Tax Map

Page Navigation

Tax Assessor Office

Phoenix House

2nd Floor

2 West Main Street

Mendham, NJ 07945

2 West Main Street

Mendham, NJ 07945

Scott Holzhauer, Tax Assessor

973-543-7152 Ext.20

Office Hours

Available by Appointment on Mondays

Lisa Smith, Tax Assessor Administrative Assistant

973-543-7152 Ext.20

Office Hours

M-F 8:30am-2:30pm

- Tax Assessment Card Look up

- Tax Assessor Office Statutory Mandates

- Identify, list on the tax roles, determine taxability and value of property.

- Equalize property taxes and manage tax appeals.

- Annual Tax Assessments

- The Tax Assessor notifies annnually by postcard all property owners informing them of their tax assessments.

- Rateables

- 1,859 Total Borough of Mendham Rateables

- 1,660 Total Residential Units Rateables

- 1,617 Class 2 (1-4 Units Residential)

- Includes 19 2-Units Residential

- 43 Class 3A (Farmland Assessment Residential)

- 1,617 Class 2 (1-4 Units Residential)

- 199 Total Non-Residential Rateables

- Includes Class 1 (Vacant Land), Class 3B (Farmland), Class 4 (Commercial)

- 1,660 Total Residential Units Rateables

- 1,859 Total Borough of Mendham Rateables

- Added Assessments

- Assessed property values are updated based on results of added assessment calculations or other adjustments.

- All open and completed building permits are tracked for added assessment purposes.

- Tax Assessment List

- Tax List is available for inspection by appointment.

- To schedule an appointment:

- email planning@mendhamnj.org

- 973-543-7152 ext.20

- To schedule an appointment:

- New deeds are reviewed to maintain an accurate tax list of properties, ownership, assessments and other data that is statutorily required.

- The Office reviews Joint Land Use Board actions, noting final approval of subdivisions for recording on the Tax List and Tax Map.

- Tax List is available for inspection by appointment.

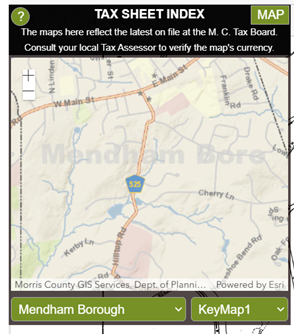

- Tax Map-Morris County GIS

- On the green drop down menu select Mendham Borough.

- State and County Tax Appeals

- Equalized Ratio

- NJ State SR-1A list is based on deed information that is used to determine the Borough's equalization ratio.

- This ratio is used for distribution of State Aid to Schools.

- 200' Certified List of Property Owners Application

- The Tax Assessor's Office prepares the requried Certified List of Property Owners within 200 feet of a property for all JLUB Development Application.

- NJ Tax Relief Programs

-

-

-

-

-

All documentary proofs must be filed with the local Tax Collector.

-

-

NJ State D5 Form-Renewal must be filed annually with the Tax Collector, on or before March 1, to maintain the deduction.

-

-

How to Appeal if Your Application Is Denied

-

If your application is denied, you can file an appeal with the County Board of Taxation.

-

NJ State A-1 Form-Appeal must be filed on or before April 1, following the denial.

-

-

-

-

- NJ State FA-1 Form-Farmland Assessment Application

- Farmland Assessment Renewal Forms are sent to all qualifying farmland properties annually by the Tax Assessor.

- Woodland Data Form for Farmland Aseessment

- 2024 Extended Tax Duplicate

-

Commercial Property Annual Income/Expense Questionnaire

.jpg.png)